ICM Direct

Institutional Trading Platform

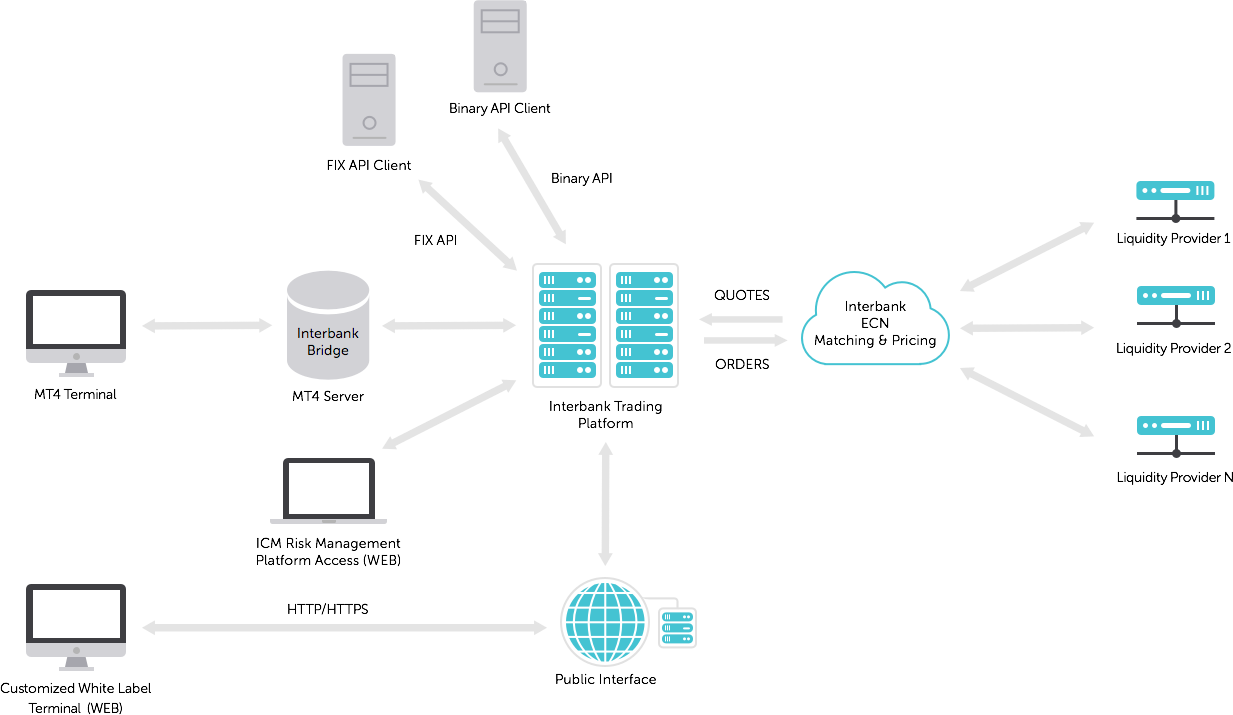

With our award-winning Electronic Communications Networks (ECN) technology institutional clients can meet their trading requirements and business needs while gaining direct market access with no conflict of interest. ICM Direct accumulates liquidity from major Tier 1 banks and top liquidity providers within one platform, allowing fast and robust execution of trading orders without additional slippage, ensuring you can optimise your daily trading activities. Competitive dealing costs and rapid trade execution ensure individual traders, brokers, and small or large institutions can gain access to institutional-level liquidity with significant advantages. FIX-based technology is provided for flexible and easy integration on a range of powerful trading systems.

ICM Direct is implemented using C++ programming language which provides the ultimate execution speed and reliability.

For our institutional clients, we offer the following bespoke solutions designed to meet your individual needs:

Dedicated Support

Enables you to spend less time managing any back office procedures and spend more time enhancing your client relationships. Our extensive experience and focused vision on the global markets ensures we have fully aligned solutions for all types of financial institutions.